Battery energy storage systems in the UK have seen revenues quadruple over the past year, new data has revealed.

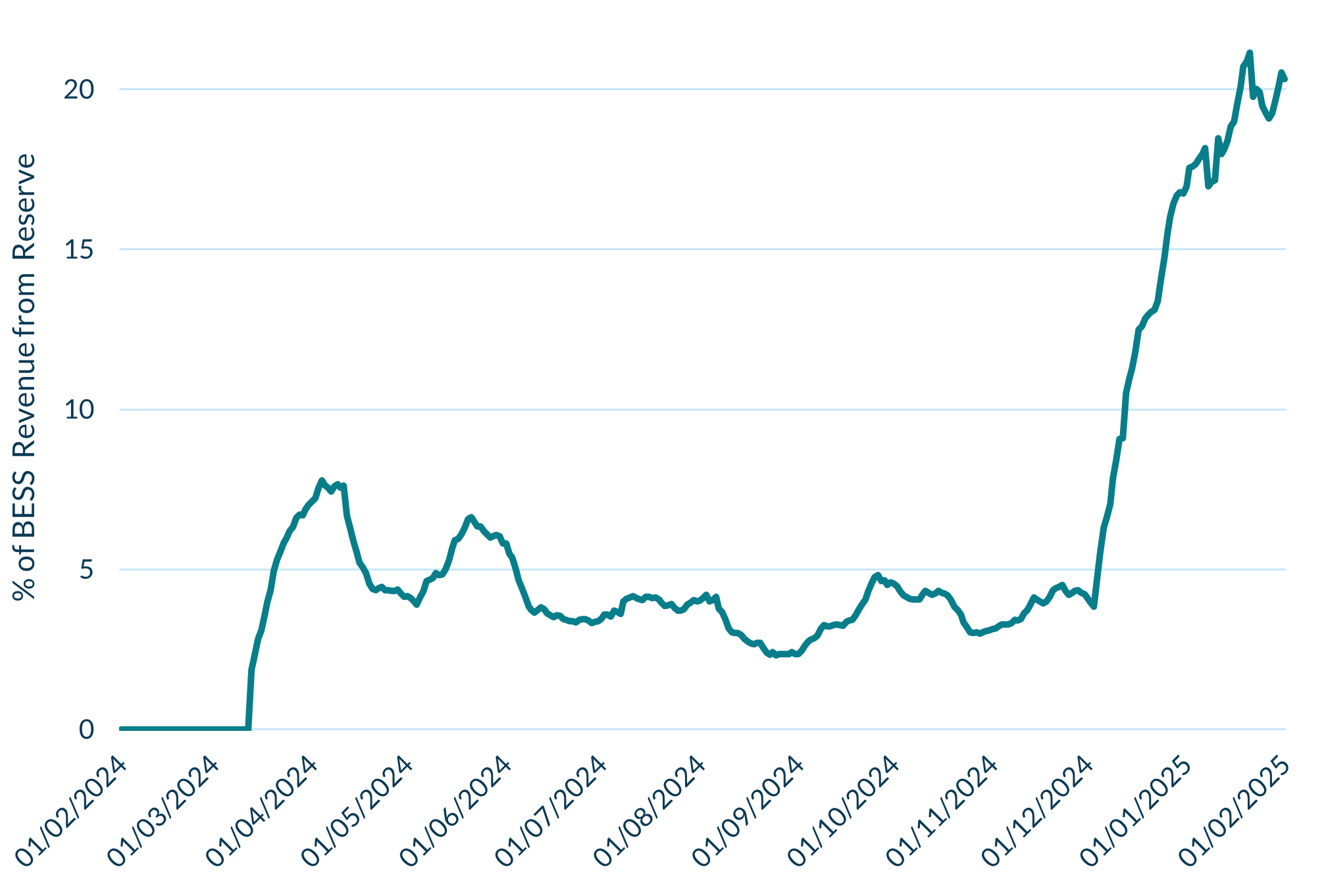

According to Cornwall Insight, the significant jump in battery revenues has largely occurred since December 2024, driven by growing demand for a grid stabilising reserve service, dubbed Quick Reserve, introduced by the National Energy System Operator (NESO). As a result, around 20% of battery revenues now stem from grid stabilising services, compared to just 4% at the start of December.

The Quick Reserve scheme, launched in November 2024, is designed to counter supply-demand imbalances by rapidly instructing batteries to ramp their energy use up (positive) or down (negative) within a minute. With renewable energy generation continuing to rise in the push towards a clean power sector by 2030, the need for rapid-response capabilities has made batteries indispensable for grid stability. Unlike other renewables, which primarily offer negative balancing services, batteries can support both positive and negative energy requirements at speed.

While the Quick Reserve scheme has been crucial at driving up revenues, Cornwall Insight also notes that part of the revenue rise is linked to tight system margins. The soaring revenue may also not continue on its current trajectory, with the BESS Analytics project pipeline pointing to a further 6GW of new battery capacity set to come online by the end of 2025, which could see increased competition and potential market saturation driving down prices.

Dr Matthew Chadwick, Lead Research Analyst at Cornwall Insight, commented, “The rapid rise of battery storage revenues from Quick Reserve highlights how critical flexibility services are becoming in the UK’s evolving energy system. Ultimately, getting to net zero will involve more intermittent energy generation coming on to the grid, and that is where batteries will thrive. Other technologies simply do not have the ability to ramp up production that quickly – Quick Reserve is a batteries market.

“Of course, as with any revenue stream, the more competition there is, the less the returns. With another ~6GW of batteries due to come onto the system this year – and more to follow – we could see revenues for Quick Reserve fall, as returns on other frequency response services have done.”