The government has announced that VAT relief on Energy Saving Materials (ESMs) in residential buildings will be extended to include home batteries, power diverters and water-source heat pumps from February 1, 2024.

The decision to extend the VAT relief will make it easier and more cost-effective for UK households to invest in next-generation solutions to improve energy efficiency and reduce energy bills.

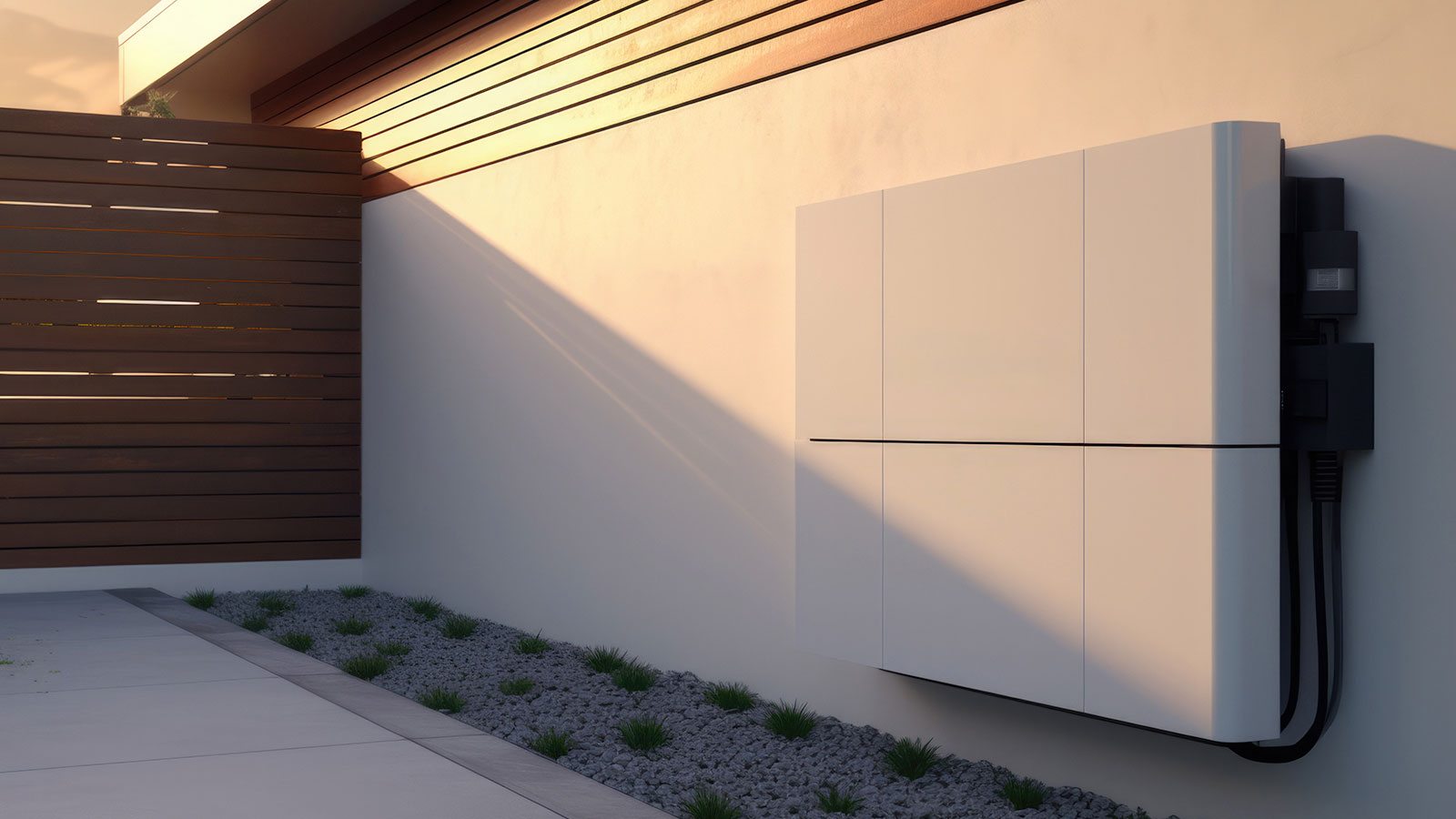

Under the current scheme, 20% VAT is payable on energy storage unless it was being installed alongside other energy-saving materials that were already exempt, such as roof-mounted solar. However, this change means that those with existing solar can now retrofit an energy storage system without having to pay the 20% VAT.

Jordan Brompton, Co-Founder and CMO of myenergi, commented, “Bringing an increasing number of tech innovations into the scope of VAT relief on ESMs is a major step forward. As well as opening up widespread financial and environmental benefits, it demonstrates the government’s commitment to ensuring that support remains firmly in-line with the rapidly evolving ESM landscape.”

Brompton also noted that the government’s decision to exclude eco-smart EV charge points from the scope of VAT relief is disappointing. “While a significant step forward, it’s disappointing to hear that eco-smart EV charge points will continue to remain outside the scope come February 2024.

“We will continue to push for change when it comes to this precise point – after all, we believe that all decarbonisation solutions should be incentivised. It seems shortsighted at best to exclude certain products from VAT relief that are already having a huge impact reducing consumers’ energy costs and reducing our reliance on energy from the grid.”