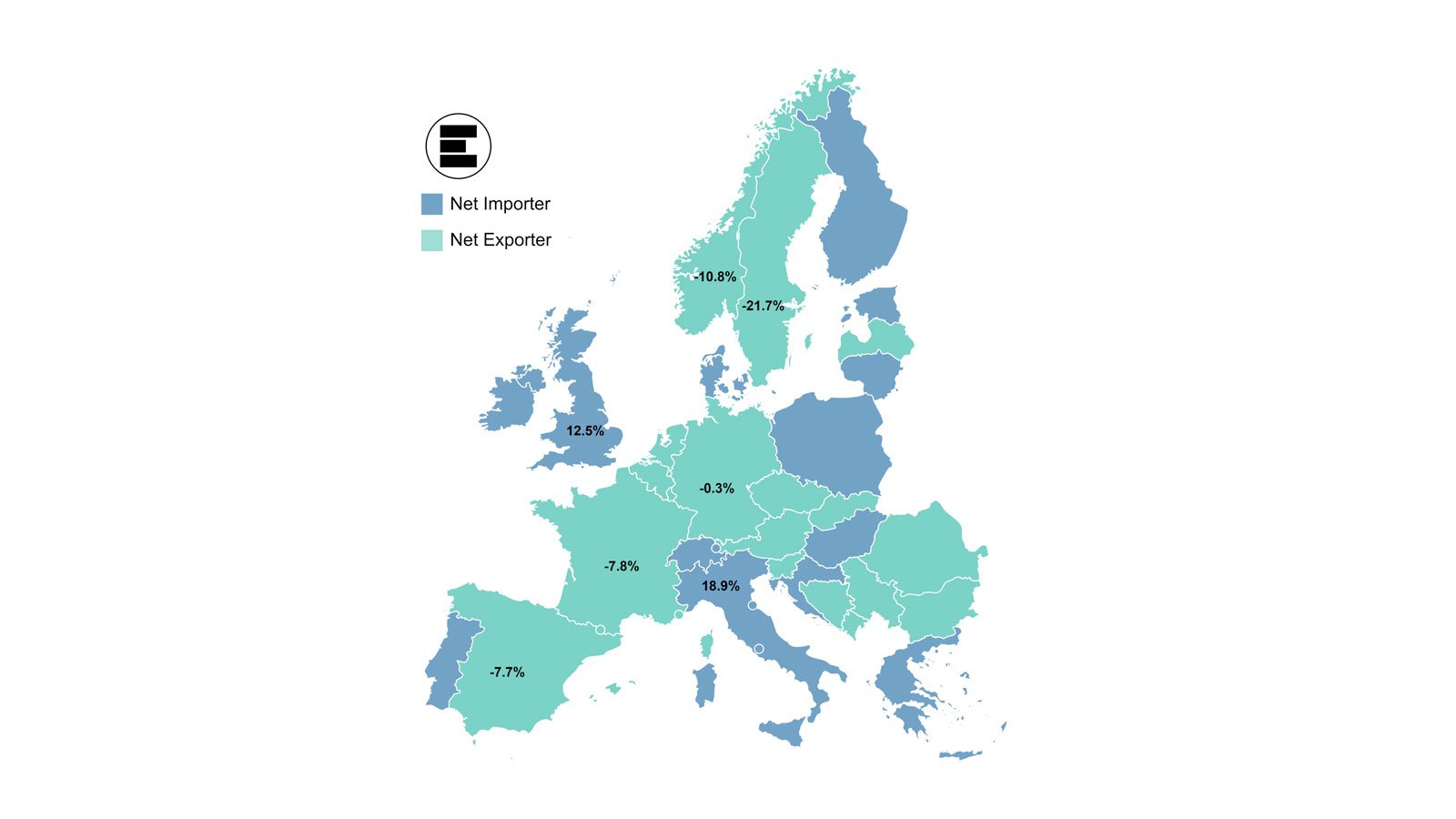

France is once again the biggest net exporter of power in Europe, retaking the position it lost to Sweden in 2022. That’s according to EnAppSys’ latest report on the European electricity market.

During the first half of 2023, France’s total net exports amounted to 17.6 TWh, which beat Sweden’s net exports of 14.6 TWh. This is a dramatic turnaround for the country that ended 2022 importing more electricity than it exported for the first time in 42 years.

The turnaround is a result of France’s fleet of nuclear reactors becoming available again after being dogged with reliability issues. The fleet was unavailable for more than half a year in 2022, while the issues were compounded due to restrictions on hydropower production caused by a summer drought.

Jean-Paul Harreman, Director of EnAppSys BV, commented, “The cause for the increase of exports in France versus the previous year was an increased availability of the country’s nuclear assets. Although availability is still 10-15% lower than normal, the increase in capacity of between 5 and 10 GW versus last year helped to flip the French energy balance to export again.

“As cheaper generation became available to the French market, it started exporting to GB again. The price differential ensured that cheaper power flowed from France to Britain.

“Meanwhile, Sweden’s exports remained stable compared to the second half of last year.”

Most of France’s exports flowed to Great Britain (8TWh) and Italy (9TWh), with the GB electricity market returning to its classic position as a net importer of electricity – having become a net exporter of electricity for the first time in the second half of 2022.

Sweden was the second highest net exporter of power in the first half of this year, sending a net 14.6TWh of power to other countries, while Spain overtook Germany to be the third highest net exporter with total net exports of 8.8TWh.

Jean-Paul Harreman added, “Spain still profits from a lower gas price for power generation and massive renewable generation. A massive solar capacity increase in Spain drove higher exports.

“Meanwhile, in Germany, the closure of nuclear power plants was the main reason why the energy balance flipped to imports. These closures meant that Germany had to source additional power from other countries in periods of low renewable generation.”

When net exports as a percentage of demand was taken into consideration, Bosnia overtook Bulgaria as the country with the highest percentage of its power generation exported (44.8%).

Gabor Szatmari, Territory Manager of central and eastern Europe (CEE) at EnAppSys, concluded,: “Bulgarian exports declined because the country’s lignite production got priced out of the merit order by broader European gas production, due to falling gas prices in Europe since August 2022. In the case of Bosnia, the total hydro production doubled from H2 2022 to H1 2023 and around 87% of that additional production was exported to other countries.”

Italy remained the biggest net importer during the first six months of 2023, sourcing 25.9TWh from outside the country, of which 9.9TWh came through Switzerland and 9.5TWh through France.