Mark Rutherford, CEO at Alexander Battery Technologies, explains why 2026 is less about scaling up and more about proving traceability, cybersecurity, and accountability across the battery supply chain.

2026 marks a different stage for Europe’s battery industry. For several years, the focus has been on scale, investment, and technological progress. That conversation hasn’t ended, but there is now a noticeable shift towards demonstrating that the systems and processes being put in place can stand up to scrutiny.

The last 12 months have provided a clear indication of what lies ahead. Across the sector, we’ve seen compliance checks, early Battery Passport pilots and audits, as well as legal disputes between suppliers and customers.

The battery passport sets the standard

The European Union (EU) Batteries Regulation has moved from concept to enforcement. By early 2027, industrial and electric-vehicle batteries over 2 kWh capacity placed on the EU market will need to carry a verified digital record linking their materials, origin, carbon footprint, and key component data. This makes the Battery Passport a formal legal requirement; without it, a product cannot be sold or shipped within the EU.

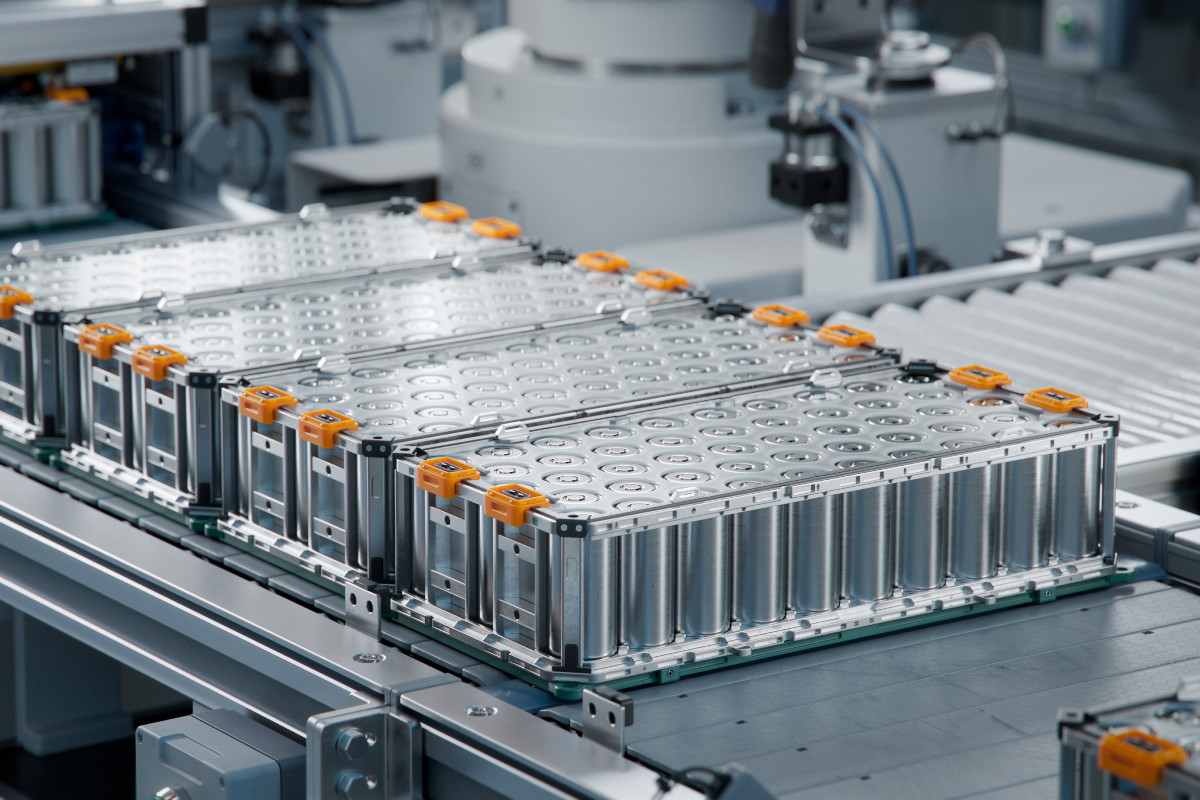

Meeting that standard means rethinking production systems from the ground up. Traceability can’t be bolted on afterwards; it needs to be designed into the process itself. Data points such as weld information, torque readings, firmware logs, and supplier records are being brought into connected systems, creating a consistent picture of every unit built.

While this level of detail affects every stage of manufacturing, it remains one of the most dependable ways to confirm that the battery delivered is the same one described in the paperwork.

When done well, it strengthens the business as a whole by reducing exposure to unverifiable imports, improving carbon reporting, and laying the groundwork for reuse and recycling. In practice, it represents a more disciplined and efficient way to run production.

Software security becomes part of quality

As more equipment relies on electric power and embedded software, the next major challenge is digital security. We’ve already seen cloned hardware, tampered firmware, and uncontrolled updates disrupt production and lead to disputes between suppliers and customers.

Buyers are now demanding clearer proof that software is authentic and secure. Signed firmware, version control, and structured audit trails are becoming standard practice in higher-risk applications. Some manufacturers have even introduced checksum verification into their end-of-line testing to confirm software integrity before a pack leaves the factory – a sensible, proactive step.

Electrical, mechanical, and digital checks now carry equal weight. From my perspective, cybersecurity has become an essential element of quality assurance. It’s now more than an IT concern; it’s an integral part of building safe, reliable products.

Litigation and insurance are changing the economics

Recent legal cases between battery suppliers and their customers have shown how accountability is changing. When a product fault arises, good intentions count for very little; the only thing that matters is the record of what was done and how.

Insurers have taken the same view. Underwriters increasingly look for evidence of process control before they will support large-scale programmes. If a company can’t demonstrate clear, reliable records of how its products are built and tested, premiums may rise or cover may be restricted.

Traceability has therefore become a factor in the financial model: strong evidence helps to keep premiums down and accelerates qualification with customers, while poor evidence adds cost and delay.

This shift is prompting every link in the supply chain to tighten its controls. At its core, it’s about keeping reliable records and being able to show exactly what’s been done – and by whom – at any given stage.

A change in what matters

Cost and chemistry will always influence how the industry competes, but they are no longer the sole indicators of progress. The ability to demonstrate control – to prove that each step has been completed correctly and consistently – now carries equal importance for customers, regulators, and insurers alike.

Different chemistries will continue to find their place. Lithium iron phosphate (LFP), nickel manganese cobalt (NMC), and newer sodium-ion cells each offer distinct advantages and trade-offs. The priority, however, is being able to produce and validate any of them within a clear, consistent framework that supports quality and traceability.

A practical way to respond is to treat traceability and documentation as core engineering requirements, not add-ons. Serialisation, end-to-end records from design through testing, and clear audit trails make it easier to answer customer questions, support compliance, and resolve issues quickly when they arise. Over time, consistent evidence and transparency become as important as performance in building confidence across the supply chain.