Brits are adopting electric vehicles at a much slower rate than many European countries, with growth having stalled significantly in recent months.

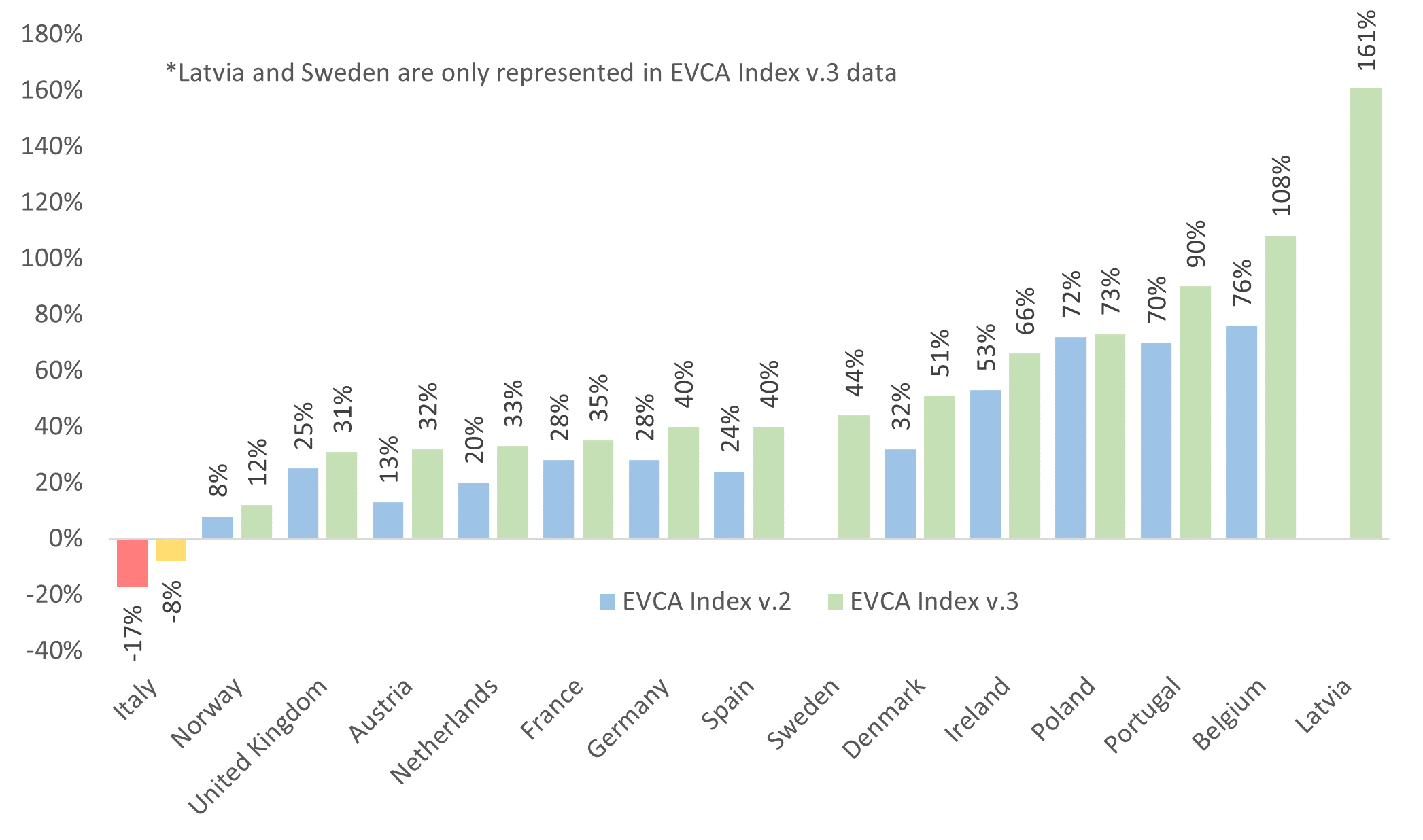

According to new data from Cornwall Insight, UK battery electric vehicle sales growth was amongst the lowest in Europe during the period of July 2022 – July 2023 at just 31%. This is compared to an average of 60.6% growth seen across the 27 European Union nations.

Now, we must precursor that we’re talking about growth – meaning how many more electric vehicles are being sold during this period compared to the previous period. So, what that means is that while the UK growth rate might be slowing – it doesn’t mean the appetite for electric vehicles has completely gone away.

In fact, the UK is still one of the leading European countries in terms of the number of electric vehicles on the road. Data shows that there were an estimated 850,000 battery electric vehicles on UK roads as of August 2023, that compares favourably to France, which was estimated to have around 761,000 in March 2023.

However, countries with large adoption rates, such as the United Kingdom and Norway, have suffered from slowing growth in recent months. While others which are still in the beginning stages of the EV transition, are starting to see higher growth figures. That includes Latvia, which saw a growth rate of 161% – although that could be the result of new incentives on electric vehicles which were instituted in the country in 2022.

UK falls in EV attractiveness

While the slowing growth figures could be explained away with the fact that the UK’s EV market is larger than some other countries in Europe, its recent fall in its relative attractiveness for investment in battery-electric vehicles cannot.

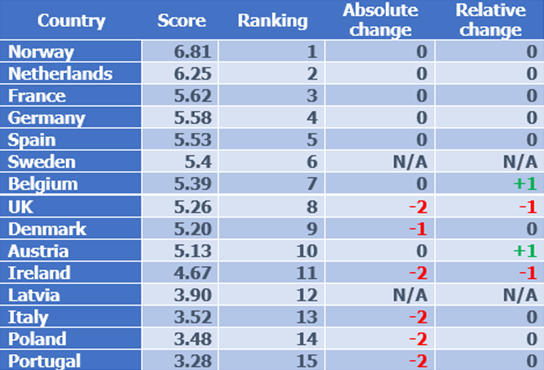

In the most recent EV Country Attractiveness Index, the UK fell two places in the ranking, as the continued lack of public charging infrastructure continued to be cited by consumers as a barrier to entry for electric vehicles. While there is now an impressive number of public EV chargers available, with more than 48,000 available across the UK as of August 2023, Cornwall Insight estimates that there’s a ratio of around 11.3 chargers for every one battery electric vehicle on the road.

Additionally, the index found cuts to BEV purchase incentives, including the de-facto closure of the subsidy scheme to help with the purchase of passenger BEVs, known as the Plug-in Grant, as well as the continued delays to the rollout of rapid charging across the UK’s motorways were slowing down BEV sales in the UK. Continued macroeconomic difficulties throughout the UK, with both high inflation and electricity prices, have only acted to compound these issues.

Cornwall Insight estimates that the Prime Minister’s announcement that the UK is to delay the ban on the sale of new petrol and diesel cars by five years (from 2030 to 2035) could further damage BEV sales growth. While still in alignment with many European nations, the watering down of BEV policy may lead to the UK’s transition losing some momentum and could potentially have an impact on both consumer and industry confidence.

Jamie Maule, Research Analyst at Cornwall Insight, commented, “Despite strong progress, the UK could now be at risk of falling behind much of Europe in the transition to Electric Vehicles. While we are still seeing growth, the removal of incentives, infrastructure delays and wider policy uncertainty remain significant hurdles for EV expansion in the UK.

“The announcement by the Prime Minister to delay the ban of petrol and diesel vehicles has compounded the challenges casting uncertainty over the UK’s EV market. This threatens to erode the country’s momentum in shifting away from traditional fossil fuel cars.

“Only by reaffirming our commitment to EV infrastructure growth, bolstering incentives, and rekindling investor and consumer confidence, can the UK reclaim lost ground and position itself among the leading nations in Europe for EV adoption.”

Chris Pritchett, Energy and Infrastructure Partner at Shoosmiths, added, “OEMs and chargepoint operators are investing billions in the electric transition and progress has been rapid, but the government’s screeching U-turn on policy threatens new investment into the UK’s wider green industry, whether it’s vehicle production, battery and semi-conductors, lithium extraction or facilities to deal with end-of-life batteries. More importantly, it frames net zero as a political wedge issue ahead of the election which is clearly (and unforgivably) aimed at dividing the consensus on meaningful climate action.

“I’m confident, though, that our business leaders in the sector will continue to set the pace on the EV transition, a rapidly converting public will join the ride, and this week’s frustrating setbacks will ultimately be nothing more than a bump in the road”.