National Grid ESO is predicting that the market will return to more normality this winter, although it has begun preparations for some unexpected disruptions.

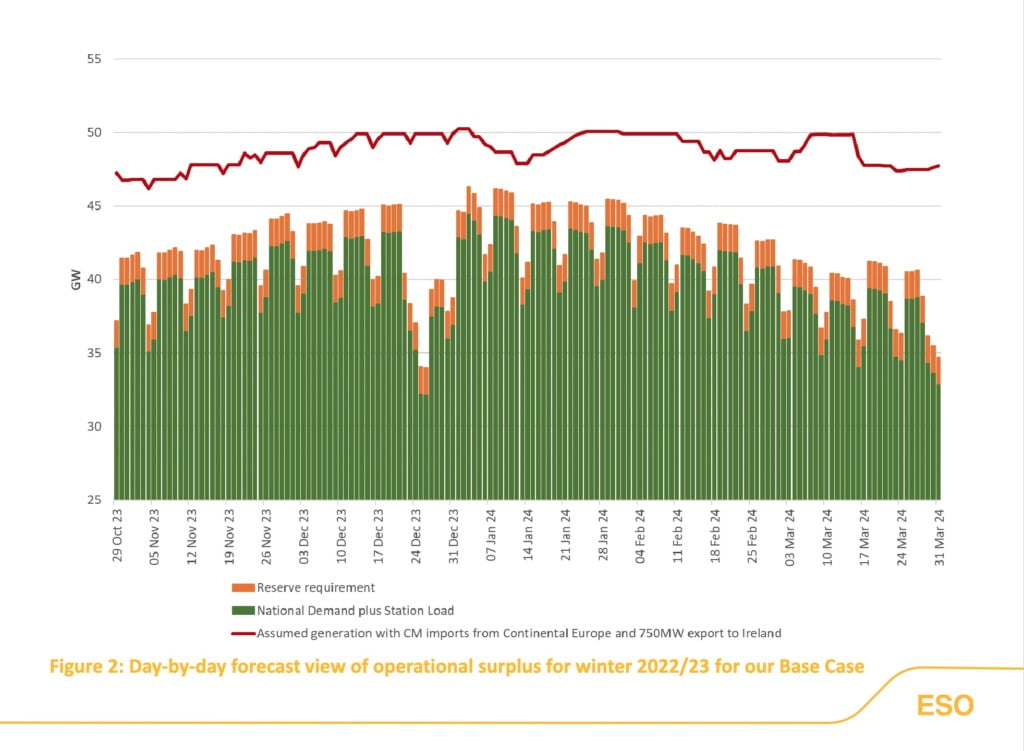

Winter 2022/23 was tougher than usual for National Grid ESO, with its Winter Outlook predicting margins of 3.7 GW/6.3% throughout the winter as a base case. Of course, there were some days where things were a little tighter, but we made it through the tough winter of 2022-23 relatively unscathed. In fact, there were no large scale outages as predicted by some prior to the winter season.

Thankfully, in its early outlook for winter 2023/24, National Grid ESO is predicting that things will be a little easier. In fact, margins will be a little higher this year, with a base case of 4.8 GW, or around 8%. That is a return to normality for the energy market, with 2021 seeing a base case of 4.3GW or 7.3%.

The optimistic outlook comes despite concerns still looming over the ongoing war in Ukraine, which has caused disruption to the generation of electricity across Europe as countries reliant on Russian gas have scrambled to find an alternative source. Thankfully, due to a milder winter through the 2022/23 season, countries have managed to fill their gas storage to record levels – with many expecting that gas storage facilities will be completely full well ahead of winter in August/September.

Not out of the woods yet

Despite the optimism, National Grid ESO is laying the ground for some tough days during the winter 2023/24 period – with it noting that there will be days in January which will see tight margins. That’s why it is planning to bring the Demand Flexibility Service back for the second year.

The Demand Flexibility Service saw energy consumers paid to reduce their electricity usage during periods of strain on the energy grid, with the system proving popular. In fact, there were a total of 22 trials of the service which took place during the winter 2022/23 season, with 1.6 million homes and businesses participating. That led to a total electricity reduction of 3,300 MWh, giving National Grid ESO a lot more headroom to maneuver during the toughest periods.

In 2023/24, National Grid ESO is hoping to get larger businesses involved in its Demand Flexibility Service. That means large energy consumers such as data centres and factories could be asked to reduce their electricity usage during peak demand to give the grid a bit more headroom.

“The demand flexibility service was principally – not exclusively, but principally – used by households last winter. Whilst we still very much want that to continue, we’re really pushing to get industrial and commercial users,” noted Jake Rigg, Director of Corporate Affairs at National Grid ESO.

According to Chris Rason, Managing Director of Aggreko Energy Services, this latest announcement shows the importance of decentralised energy technologies in ensuring the manufacturing sector can continue operations unimpeded.

“This request from the National Grid is a troubling one – especially for manufacturers,” he said. “Energy scarcity is rapidly supplanting fluctuating power prices as industry’s chief concern. This is unsurprising – insufficient grid supply is an existential threat to day-to-day operations, and requests to cut back or shift energy usage to outside peak times are definitely worrying for manufacturers.

“The disruption that may ensue because of this will hold back the sector at a time when UK manufacturers are often at their busiest. More flexible approaches to powering factories, including on-site power generation, must be explored if British businesses are to remain competitive at home and abroad.”

While National Grid ESO wouldn’t argue against more on-site generation, given it reduces strain on the grid, the company does believe that the Demand Flexibility Service could offer a lifeline to businesses that are facing high electricity bills. That’s because of the high price it pays for each kWh in reduced electricity – which could significantly add up for large electricity users.

More coal for the foreseeable future

Another key tenet of National Grid ESO’s preparations for the winter 2023/24 season is plans to bring coal-fired power plants online and ready to step-in if needed.

As part of those plans, National Grid ESO is currently in negotiations with Drax to bring two coal-fired generators online at its power plant in Selby, North Yorkshire. That could derail Drax’s plans to convert its remaining two coal units to Combined Cycle Gas Turbine units, which it announced back in 2019.

Thankfully, Uniper’s Ratcliffe-on-Soar is already online and has even been providing electricity to the grid during the previous week’s heatwave, as air conditioning use soared. That means National Grid ESO has secured at least one of the five coal generators that it had on standby during the winter 2022/23 season.

West Burton A, meanwhile, will definitely not be available after EDF announced that it was to close after 57 years of operation. The Government had tried to keep it open for next winter, although EDF declined noting that it faced both maintenance and staffing issues that would have made it unfeasible.

Could the UK continue to be a net exporter of electricity?

In 2022, the UK became a net exporter of electricity for the first time ever – despite the challenges associated with the winter period. It ended the year with net electricity exports of 5.3 TWh, which compared with net imports of 24.6 TWh in 2021.

In its Winter Outlook, National Grid ESO is confident that the UK will be able to have periods where it exports electricity to the rest of Europe, even during some peaks. While that doesn’t mean that the UK will once again end the year as a net exporter, it certainly gives us confidence that the unfounded fears around the 2022/23 winter season won’t rear their ugly heads again in 2023/24.