The zero rate for residential batteries is here! It’s a step towards the mainstream, says Griff Thomas from GTEC, but some clarification of scope is needed.

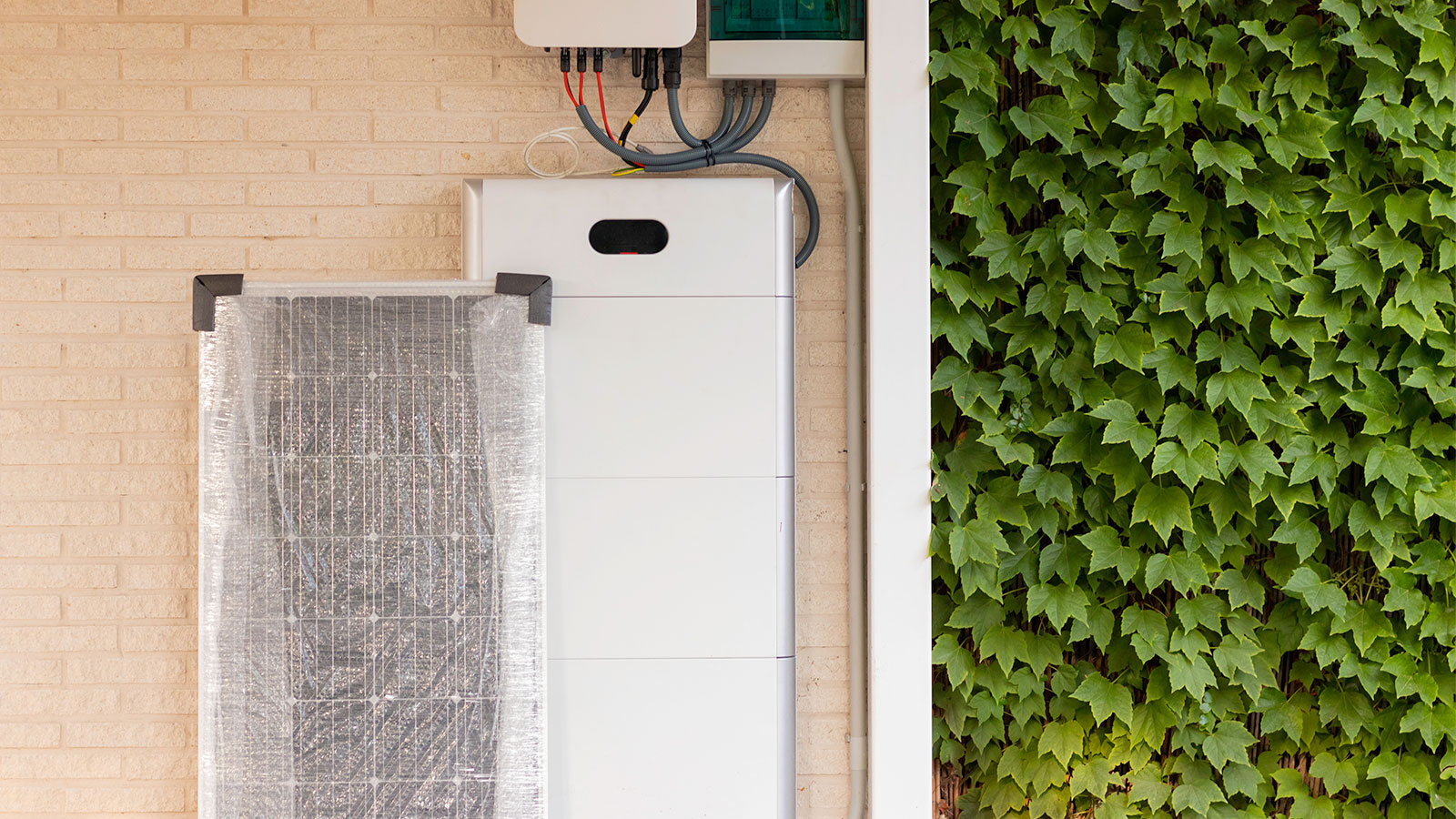

As from February 1, 2024, all battery storage systems installed in UK homes benefit from a VAT exemption regardless of whether they are fitted at the same time as solar PV. This equals the playing field for retrofit applications which previously would have been subject to 20% VAT.

The expansion of the zero rate VAT reflects the need for low carbon systems to evolve alongside the development of new technologies, incentivising energy efficiency improvements at all stages of the life cycle. It is not clear at this stage, however, if this change includes the ‘standalone’ batteries which could also contribute to reduced bills and better energy management.

‘Smart diverters’ are also included but it is yet to be tested, for example would you call an EV charger that can divert solar energy to a car battery a ‘smart diverter’?

Battery boom

Last year was a bumper year for residential battery storage, a technology that offers great potential for the transition to low carbon energy with wide-ranging benefits for both consumers and the grid. According to MCS, battery storage has become the third most popular tech type to be installed with 4,400 of the 4,700 certified battery installations on its records completed last year. An additional 800 contractors were certified in 2023, up from just 50 in 2022.

With Smart Export Guarantee (SEG) payments usually far less than 50% of the cost of importing electricity, there are clear savings to be made by using a battery alongside solar PV, but the benefits extend beyond self-generation. Residential batteries broaden the scope of heat pumps for harder-to-treat homes where higher flow-temperatures may be required, minimising running costs by allowing access to off-peak charging.

Batteries for all

As the prices of batteries and hopefully electricity come down, and more energy providers adopt the flexible and technology specific tariffs that Octopus has been a champion of, in the future I expect most homes will have a battery of some sorts – in their houses, or on their drives.

As I mentioned above, the guidance on the most recent VAT change includes ‘smart diverters’, but clarification is needed for those who charge their cars directly from solar, plus battery users benefitting from smart tariffs without a microgeneration system. These groups may currently be in the minority, but capital cost reductions are an important way to incentivise take-up across the board.

Overall, the VAT exemption is a welcome step towards residential energy storage moving towards the mainstream.